Savings Account Benefits

With a Security Bank savings account, you will enjoy all of the following benefits:

Springfield Illinois Mutual Bank Security Bank is the local mortgage leader in Springfield, Illinois. Mortgage Auto Banking. First Security Bank has numerous bank locations throughout Arkansas. Online banking, mobile banking, personal checking, business checking, loans and investments. Free checking, interest checking, credit card, mortgage, cash management, home equity loan, business loan, kids savings, minor savings.

- Free Online Banking

- Free Mobile Banking (Message and data rates may apply)

- Free eStatements

Compare Our Savings Accounts

| Account Type*** | Required Opening Balance | Interest Bearing?** | Activity Fees / Requirements |

|---|---|---|---|

Statement Savings Looking simply to save money? This account is perfect to start saving and earn interest with a low minimum balance required. | No minimum deposit required to open the account. | Interest will be credited to your account quarterly. | A service charge of $5.00 will be imposed every month if the daily balance falls below $100.00 any day of the month. |

Youth Savings This account helps teach and reinforce the long term value of saving with a higher interest rate. | $25.00 | If your daily balance is $500 or less – 5.00% APY. | For more than one withdrawal per month, you will be charged $1.00 per withdrawal. |

$500.01 to $5,000 – 2.50% APY | |||

An interest rate of .15% will be paid only for the portion of the daily balance which is greater $5000. | |||

Money Market Earn a competitive interest rate in an account that allows you to write checks. | $1,000.00 | Variable interest rates; interest accrued daily on collected balance and is compounded and paid quarterly. Rates are tiered to give you higher rates for your higher balances. | Service charge of $5.00 per month plus $.20 per debit if the daily balance falls below $1,000.00. |

Super Money Market Excellent savings account for those investors who can maintain higher account balances and can access the account by writing checks. | $10,000.00 | Variable market rates; interest accrued daily on collected balance and is compounded and paid quarterly. Rates are tiered to give you higher rates for your higher balances. | Service charge of $5.00 per month plus $.20 per debit if the daily balance falls below $10,000.00. |

Christmas Club This account is perfect for putting away money each week to access just in time for the holidays | $2.00 | Yes | Maximum amount you may deposit is $50.00 per week. |

Health Savings Account | $100.00 | Interest will be credited to your account quarterly. | No fees if withdrawals are by debit or check. |

**At our discretion, we may change the interest rate and the annual percentage yield on Statement Savings, Youth Savings, Money Market Savings, Super Money Market Savings, Christmas Club Savings Accounts and Health Savings Accounts at any time. If you close your account, any unpaid accrued interest will not be credited to your closing balance. Interest begins to accrue on the business day you deposit cash and/or non-cash items. We use the daily balance method to calculate the interest on your account. This method applies a daily periodic rate to the principal in the account each day.

*** Regulation D transaction limitations: Limitations to the Statement Savings Account, Youth Savings Account and Money Market Accounts apply to pre-authorized transfers, automatic transfers, telephone transfers, computer transfers, checks drafts, debit card transactions, or by similar order to third parties are limited to no more than six per statement cycle. Transaction limitations do not apply to transfers or withdrawals made by mail, messenger, ATM, or in person. If you exceed the transfer limitations set forth above, your account will be subject to change or closure.

[Last updated 19 May 2020] Security Bank (Philippines, PSE: SECB) is one of the country’s leading and most trusted universal banks serving retail, commercial, corporate, and institutional clients. Through the decades of dedicated banking operations since 1951, it has proven its financial management expertise, stability, consistent profitability, and continuous growth.

With a renewed brand promise ‘You deserve better,’ Security Bank commits itself to providing client-centered solutions to the banking needs of Filipinos along with its wide range of financial services – financing and leasing, foreign exchange and stock brokerage, investment banking, and asset management.

In the recent years of stiff competition, Security Bank has established a nationwide presence in the Philippine archipelago through aggressive expansion efforts – growing number of servicing branches and strategic ATM locations (source: Security Bank official website).

Security Bank Deposit Products (Savings)

[1] All-Access Checking Account (Initial Deposit: PHP 5,000.00) is a savings and checking account in a package that can be a perfect choice for depositors who manage a highly active personal cash flow. It comes with a passbook, a checkbook, and a debit (ATM) MasterCard and allows an easy access to funds for daily personal and business transactions.

[2] Easy Savings Account (Initial Deposit: PHP 5,000.00) is a basic and the simplest savings account offered by Security Bank that can be ideal for beginners. It comes with a debit MasterCard that can be used for shopping, dining, and paying bills online and offline.

[3] eSecure Online Savings Account (Initial Deposit: PHP 5,000.00) is a high-yield savings account for existing Security Bank Peso Casa clients. It can be a good partner in pursuing savings goals.

[4] Build Up Savings Account (Initial Deposit: PHP 5,000.00 [regular] and PHP 50,000.00 [premium]) promises an interest rate almost four times higher than any other traditional savings accounts. It can be a perfect account for serious and highly-disciplined savers who have long-term financial goals.

[5] Money Builder Savings Account (Initial Deposit: PHP 10,000.00) is another high-interest savings account offered by Security Bank that can be worth recommending to consistent individual savers, freelancers, sole business proprietors, and even corporations.

[6] US Dolloar Savings Account (Initial Deposit: USD 500) is a foreign-currency savings account that promises a safe and secure dollar remittance depository. Security Bank offers one of the highest interest rates for this special type of account.

[7] Chinese Yuan Savings Account (Initial Deposit: CNY 3,500) is Security Bank’s account designed for those who want to maximize their earning potential using CNY.

[8] Third Currency Accounts are non-interest bearing savings accounts that keep your foreign currency safe and secure. They can be opened using the following legal tenders: Hong Kong Dollar (HKD), Singapore Dollar (SGD), Australian Dollar (AUD), Canadian Dollar (CAD), Chinese Yuan (CNY/RMB), Japanese Yen (JPY), British Pound (GBP).

*All Security Bank deposit products earn interests at varying rates. Visit their official website or the nearest servicing branch to make inquiries about other deposit products, required maintaining balance, and existing interest rates.

Security Bank Account Opening Requirements

Here are the minimum documentary requirements upon opening a savings account with Security Bank (requirements may vary depending on deposit accounts):

- Accomplished Account Opening Online Form (submitted online)

- SMS-Received Reference Number

- 1 Primary or 2 Secondary ID Cards

- Required initial deposit

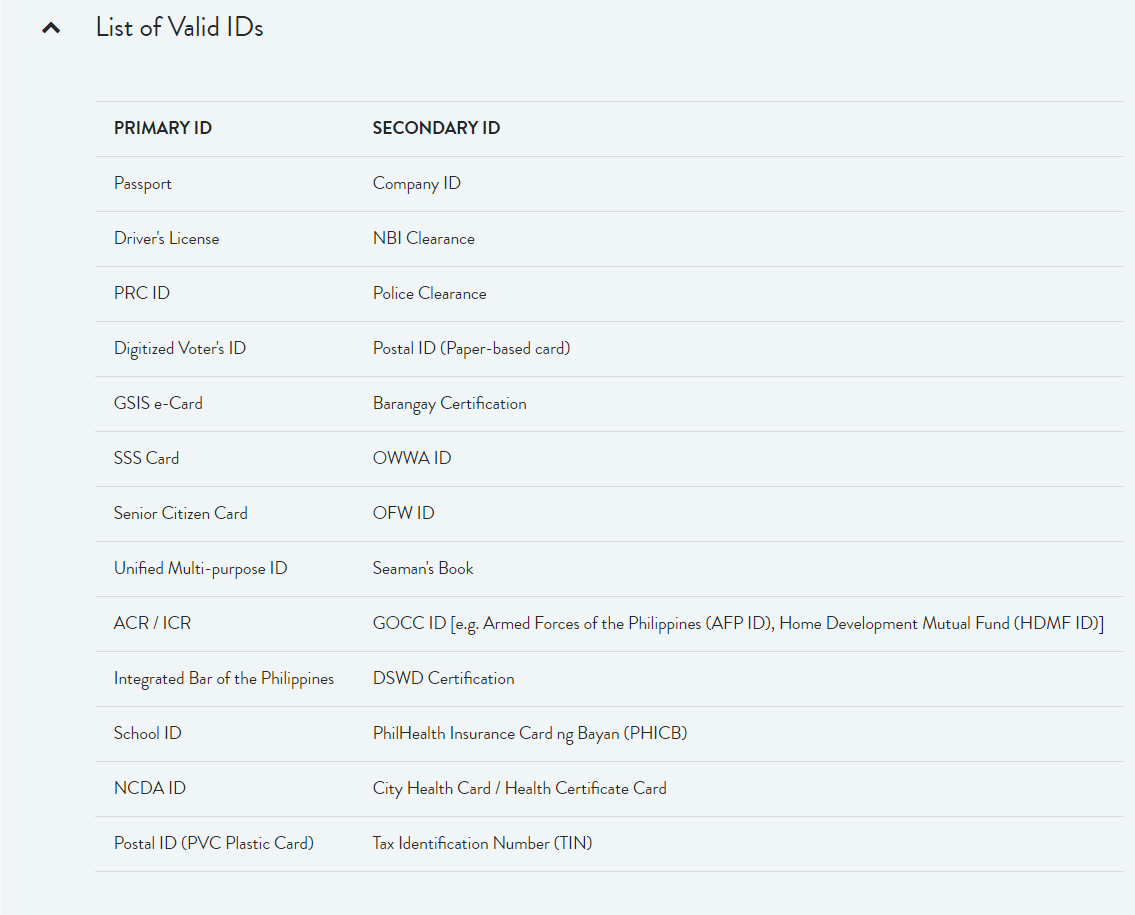

Here is the list of valid photo-bearing identification documents issued and signed by an official authority and recognized by Security Bank:

Primary Identification Cards

- Passport

- Driver’s License

- Professional Regulations Commission (PRC) ID

- Digitized Voter’s ID

- Government Service Insurance System (GSIS) e-Card

- Social Security System (SSS) Card

- Senior Citizen Card

- Unified Multi-purpose ID

- Alien Certification of Registration (ACR) I-Card

- Integrated Bar of the Philippines ID

- School ID

- NCDA ID

- Postal IC (PVC Plastic Card)

Safest Banks For Savings Account

Secondary Identification Cards

- Company ID

- National Bureau of Investigation (NBI) Clearance

- Police Clearance

- Postal ID

- Barangay Certification/Clearance

- Overseas Workers Welfare Administration (OWWA) ID

- OFW ID

- Seaman’s Book

- Government Office and GOCC ID, e.g. Armed Forces of the Philippines (AFP ID), Home Development Mutual Fund (HDMF ID)

- Department of Social Welfare and Development (DSWD) Certification

- PhilHealth Insurance Card ng Bayan (PHICB)

- City Health Card/Health Certificate Card

- Tax Identification Number (TIN) Card

Security Bank Account Opening Procedure (3 Easy Steps)

Opening savings and other deposit accounts, along with requirements, can be almost the same across all banks in the Philippines. As what I have experienced with major commercial banks, the usual process comes with a few forms, ID cards and other requirements, and verifiable personal details. With Security Bank, opening an account has been made faster and hassle-free in three easy steps:

[1] Complete the Account Opening Online Form. Visit the official website of Security Bank and click Open an Account (links can be found on the mid-page promotional photo, on the page footer, and on the Accounts menu). Accomplish the series of Online Account Opening forms and click Submit.

[2] Receive Your Reference Number via SMS. After accomplishing the Account Opening Online Form, you will receive an SMS (mobile message) confirmation together with your reference number.

Security Bank Savings Account Requirements

[3] Visit Your Selected Security Bank Servicing Branch and Finalize the Process. Hand over your prepared account opening requirements to the bank clerk (Check Account Opening Requirements listed above). Make your initial deposit and claim your debit MasterCard and/or passbook whichever is applicable and available.

First Security Bank Savings Account Routing Number

Other Related Articles:

Security Bank Savings Account Maintaining Balance

Disclaimer: The author is not directly affiliated with Security Bank Corporation (Philippines), however maintains a payroll account. Please take this article as a simple tutorial on how to open a deposit account with Security Bank and not a help page for your other concerns and issues with the bank.